MY WIFE BOOKS an appointment with a nephrologist. A nephrologist—we learn—is a kidney specialist, and there are two reasons my wife will see one. First, a primary-care doctor has flagged excess protein in her urine. Excess protein is most likely due to dehydration, the doctor explains, but there’s a chance it could be something kidney related. She refers my wife, just in case. But this isn’t the only reason my wife will see a nephrologist. The second reason she will go is because she can; I have a new teaching job—fourth grade—and the school pays for half of a decent PPO plan. For the first time in five years, my wife and I can visit a wide network of specialists. We have entered our Age of Less-Shitty Health Insurance.

“Call me as soon as you’re out,” I tell her.

She promises she will.

IN MY EARLY 20s, I began saving my health insurance cards. Every new job, every move, every change in plans. Anthem BlueCross, Molina, Oscar… My collection has become a stack, inches thick. I don’t know why I started collecting them. I must have found something darkly absurd with the system even then, back when I had no need for doctors or hospitals. When everyone I loved and would come to love was healthy, and always going to be so.

My wife calls after her appointment. She is trying not to cry. Then she’s crying. She’s not dehydrated, she tells me. The nephrologist, by examining her blood and a patchwork of past records, has determined that her kidneys are in rapid decline. Have been in decline for approximately five years. Had my wife been diagnosed earlier, the nephrologist explains, treatment would be a different story. But now, after a half decade of unchecked deterioration? The nephrologist is blunt: This is extremely serious, she tells my wife. Your kidneys are failing.

WALK COMPOST BUCKET to neighborhood garden. Bike at sunset. Read in bed. Cuddle with Dog. Watch stand-up comedy. Stay present. What has happened has happened. We are husband and wife. We have now. The past shouldn’t matter. But oh my God it does.

The five years in which my wife’s kidneys were failing overlap almost precisely with our Age of Extremely Shitty Insurance. During the Age of Extremely Shitty Insurance, I tutored, I installed solar panels on rooftops, I taught at a youth prison. I weighed crates of lobsters as a deckhand on a boat. My wife taught movement: Pilates, yoga, choreography. She was an adjunct in the dance department of a large university. Years of good, socially useful labor, and none of it came with insurance. We purchased private insurance through Covered California, the state’s Obamacare exchange. We bought insurance because we had to—coverage is mandatory in California—and because we needed to: My wife was vaguely unwell, and we didn’t know why. But do not make the mistake of confusing health insurance with health care. We did.

TWO PILLARS of Extremely Shitty Health Insurance:

1. Networks too narrow.

2. Deductibles too high.

WITH THE EXCEPTION of a few PPO plans, the majority of the Obamacare options we had were HMOs. We discovered that HMOs, to put it plainly, are shit. In our experience, you’re not covered if you want to see a specialist without a referral from a primary-care doctor. Even if you have seen countless primary-care doctors in the past, as my wife had. Even if you know every question they’ll ask. Doesn’t matter. So fine. You’ll play by HMO rules.

But then comes the first pillar: networks so narrow they are practically one-dimensional. Good luck finding a primary-care doctor nearby who is accepting new patients and has an open appointment in the non-distant future. And that’s for primary care. You want a nephrologist? Ha. Even if you didn’t need a referral—which you do!—you’d have better luck in Vegas.

Then, looming above all, is the second pillar: the annual deductible. Our deductible with one company was more than $12,000. When we changed plans the next year, our deductible was nearly $14,000. Catastrophe aside, no family will ever hit those numbers. What this means is that almost every visit costs full price. Eye-popping bills have an instant chilling effect: My wife slowly convinces herself that maybe she doesn’t need a doctor. Maybe she just feels sick because she’s not getting enough sleep? Eating the wrong foods? Exercising too much? She cuts caffeine. Spends less energy—less time, less stress—trying and failing to find a doctor who can help.

This is how Extremely Shitty Health Insurance works: not by denying claims, but by making it nearly impossible to access care to begin with. Death by a thousand hurdles. Extremely Shitty Health Insurance, we decide, is closer to a theoretical concept of insurance than anything useful. Attempting to use it triggers a series of small battles, which is—by definition—a war. And unless you are quite fortunate, our insurance battles are yours, too. But you already know this. This is our story. This is America.

AMERICA'S FOR-PROFIT health insurance system took off during World War II, when—

No. I can’t. I’m a calm man by nature—just ask my students—but discussing health insurance has the same effect on me as leaf blowers: Merely thinking about the topic makes my blood pressure climb. Healthier to take deep breaths. Go for a jog. Be present for my wife in the days leading up to her kidney biopsy. The nephrologist needs a tissue sample to learn what is causing the damage and what—if anything—can be done to halt it. Until the biopsy, there is nothing to do but live life and wait.

I HATE TALKING about insurance. I can’t stop talking about insurance. These two facts are both true at once.

I can’t possibly not explain, for example, how health insurance exists in cycles, and how each cycle begins with immediate delay. If you’ve recently moved, or experienced another “Qualifying Life Event” that allows you to change your health care, your new Obamacare insurance won’t kick in until the first of the next month after enrollment. Until the first of next month, cross your fingers. Buckle your seat belt. Hope your kidneys are not deteriorating.

We change Extremely Shitty Health Insurance plans. My wife searches for a doctor. Your insurance does not cover that doctor, she is told. Not that doctor, either. That doctor is a specialist; you’ll need a referral. That primary-care doctor is out of network. That one isn’t accepting new patients. That one has an appointment open—in five weeks.

Five weeks later, the doctor is running late. The family clinic—the one place she found accepting our insurance and new patients—is overcrowded, overwhelmed. My wife has work. She misses work. She waits. Her name is called. Two months after enrolling with insurance, she is finally in a room with a doctor. She describes her symptoms—chills, aches, fatigue, nausea. Blood is taken. A follow-up appointment is scheduled at the next available date, in five weeks.

Five weeks later: The doctor she last saw works here only Wednesdays and Fridays. Nobody told you? Your blood work? Huh, we don’t seem to have the results. We’ll need new samples. Now please, tell me, what brings you here today?

The cycle resets. No genuine care is administered. Meanwhile, my wife’s kidneys continue their quiet decline.

We upgrade my wife’s plan from Bronze to Silver in hope of better results. The next open enrollment period, we ditch the company altogether and switch to another. Nothing helps. Why is this so hard? We are intelligent people. How could going to the doctor be this confusing? My wife only wants to know why she is sick. What are we paying for? At some point it becomes difficult to believe that the hurdles themselves are not the core of any health insurance company’s business model. It becomes difficult to extend the benefit of the doubt. Are they sincerely trying to help? Because we are trying. We’ve been paying our premiums. For years.

I TALK ABOUT insurance with my father-in-law at the kitchen table. I talk insurance with other teachers at lunch. My brother and parents on the phone. My friends. I don’t want to be this person. Am I insufferable? I try not to talk about insurance with my wife—stress is unhelpful—but I do. God grant me the serenity to accept the things I cannot change. God grant me the space to remind everyone that America’s health insurance industry provides zero health-care services of its own.

That means, for example, that none of Oscar’s 2,600 employees are paid to nebulize your asthmatic nephew. Not one of the 14,000 people working at Molina is responsible for helping your mother when she seizes. Don’t bother asking any of the 98,000 employees at Anthem BlueCross to treat your wife’s kidneys.

What, then, do these corporations do?

They collect our monthly premiums. They use a portion of that pool to cover “direct health-care costs”—for example, the hospitals, doctors, and nurses who treat us, as well as the medications we need. The companies pay their overhead and administrative costs and tally whatever is left as profit.

We could say that they benefit from us as a society, yet benefit at our expense.

We could ask a biologist what to call such a relationship.

Any biologist could tell us.

The relationship is parasitic.

MY WIFE AND I, in the days leading up to her biopsy, are anxious. My wife’s mother died of cancer. Cancer looms on the worried frontiers of our minds. On the eve of the biopsy, the hospital calls. My wife thinks it might be the nephrologist with a last-minute reminder. It’s not the nephrologist. It’s the billing department, asking for $3,600: a prepayment for tomorrow’s procedure.

After a brief panic, an Internet search assures us that prepayment, while phrased to sound mandatory, is not. Prepayment is a new tactic used by hospitals to secure the goods from patients without involving insurance. If this sounds manipulative and mildly immoral, I agree. Also, I get it: Hospitals want to avoid dealing with insurance just as much as you and I do.

Correspondence from the Age of Less-Shitty Health Insurance, excerpts:

Your hospital will bill you separately for hospital services; this is for professional fees only.

This is a bill.

This is not a bill.

This bill is for laboratory work requested by your physician.

These charges were not included in your physician’s bill.

Your insurance has been billed twice.

They have not responded or made payment.

We are unable to process the following claim.

Your insurance coverage was terminated on the date of service.

If you believe your insurance is responsible, please contact them directly.

The service was reviewed and it’s not approved.

If payment in full has been sent, disregard this notice.

Please provide the necessary information and re-file the corrected claim, in its entirety.

Immediate payment required.

Act immediately.

Please make payment immediately.

This is your 2nd notice.

This is your final notice.

Dear Member: We hope to see you again if your health-care need arises.

IS THERE SUCH a thing as Non-Shitty Health Insurance? Call me a skeptic. Insurance, at its historical heart, is a financial instrument, meant as protection from uncertain loss:

Your spice caravan may perish in the Gobi, or it may not.

Your tea ship may sink in the Atlantic, or it may not.

Your phone may shatter on the bathroom tiles, or it may not.

But we are not objects. We are people, bound to our magical, mortal bodies. There is no may not. There is disease. There are accidents. There is—if lucky—old age. Insurance is the wrong tool to treat the inevitable. When my wife needs care, I don’t want financial protection from uncertain loss. The loss is happening. Do not talk to me about deductibles. There is no maximum out-of-pocket. I will do anything.

BIPOSY RESULTS are back. No cancer. Joyous news. My wife’s kidneys have not failed. More joyous news.

But: Her kidneys have half failed.

Scar damage. Fifty percent. Irreversible.

Words the nephrologist speaks from behind her N95. She is baffled: A doctor should have caught this years ago. How was this allowed to go undetected for so long? We don’t waste her time explaining how Extremely Shitty Insurance made a relatively simple diagnosis impossible for us to obtain. We can hardly understand it ourselves—how my wife was unable to see the same primary-care physician long enough to flag the issue, order blood work, schedule a follow-up, analyze blood work, refer her to a specialist. A straightforward process that would have required a continuum of care but which our HMO—

No. We won’t bother the nephrologist with this. Her job is not navigating insurance. Her job is treating my wife. She offers a tentative diagnosis: IgA nephropathy, an inflammatory disease. But the nephrologist isn’t sure; my wife’s labs don’t present like the IgA on which she has published. The nephrologist wonders aloud: Alport syndrome? She orders a genetic panel. Whatever the cause, the goal is remission. Halt the decline.

How?

Lessen inflammation. Lower blood pressure. Avoid stress. Stress raises blood pressure, and high blood pressure is a destructive force on kidney function.

So my wife gets plenty of sleep. Exercises daily. Eats healthy. Cuts work hours. Walks with friends. Cuddles with Dog as often as Dog will tolerate cuddles.

And yet she must continue to visit the lab to give blood and urine. She must see the nephrologist. She must navigate claims, co-pays, networks. Insurance greets her at every step. How does one avoid stress yet receive health care in America?

What is the sound of one hand clapping?

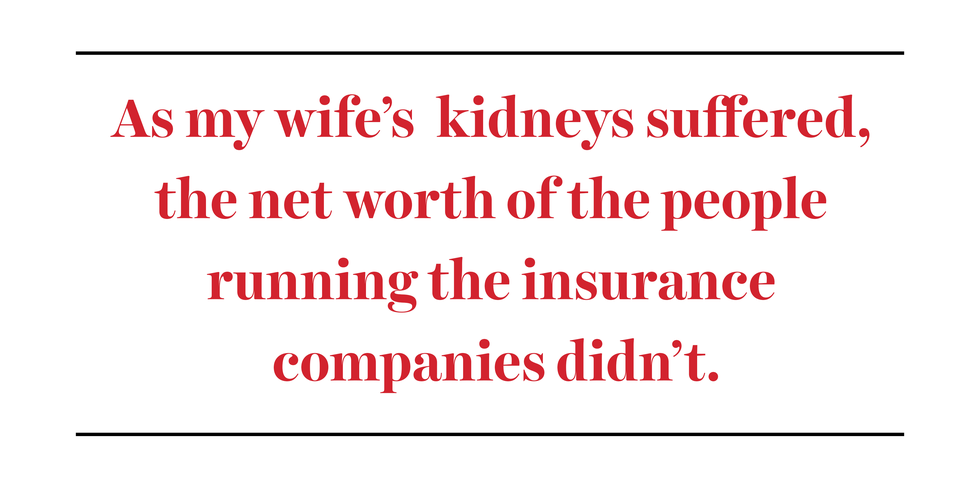

AS MY WIFE'S KIDNEYS suffered, the net worth of the people running the insurance companies didn’t. In 2018, for instance, Molina’s president and CEO, Joseph M. Zubretsky, received a $3.9 million bonus. He is not—has never been—a doctor.

The health-care startup Oscar was cofounded by Josh Kushner, brother to Jared—husband to Ivanka, son-in-law to Donald. Oscar has a cheeky, techy flair. Kushner and his cofounders, just like Joseph M. Zubretsky, have no medical background. He is a billionaire venture capitalist who made a fortune on companies like Instagram and Warby Parker. He recently bought a Manhattan penthouse from his family’s real estate firm for $35 million.

The CEO of Anthem BlueCross, one of the largest health insurance corporations to ever exist, is Gail Boudreaux. In 2021, she made $17,109,952.

In 2021, Joseph M. Zubretsky made $17,812,327.

In 2021, on the day of Oscar’s IPO, Josh Kushner’s shares reportedly became worth $1.1 billion.

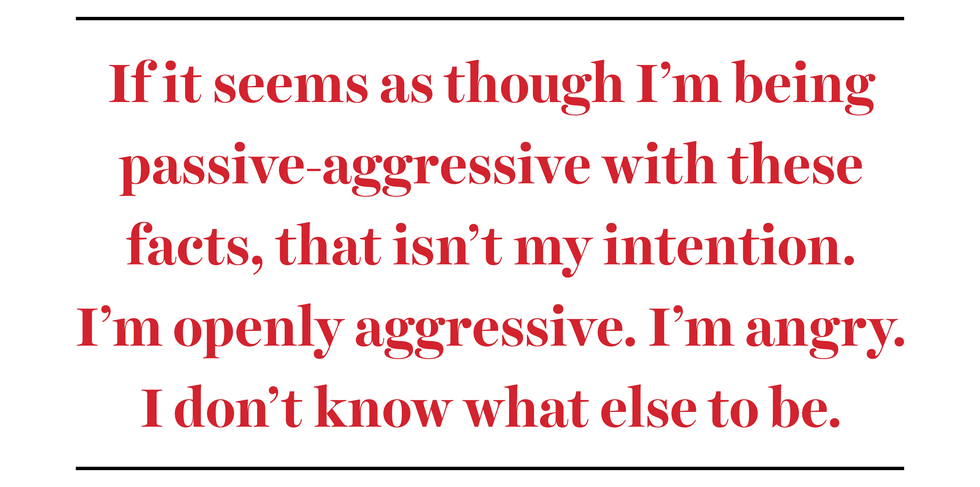

If it seems as though I’m being passive-aggressive with these facts, that isn’t my intention. I’m openly aggressive. I’m angry. I don’t know what else to be.

MOLINA HEALTHCARE (MOH) Q2 2018 results, earnings-call transcript:

Number of times word doctor is spoken: 0

Number of times word hospital is spoken: 0

Number of times word patient is spoken without prefix in- or out-: 0

Example: “inpatient cost.”

Example: “outpatient fee schedule.”

Imagine a school-board meeting with no mention of teacher or school or education. Imagine the board isn’t pretending to discuss anything but profit. Imagine what it must be like to feel so secure—so comfortable in the take—that you don’t even need to fake it.

LAST YEAR, before Thanksgiving, our insurance company denied the genetic panel the nephrologist had ordered to test my wife for Alport syndrome. Panel testing is investigative and not medically necessary because we have not seen information that panel testing improves health.

We will pay $1,500 for the genetic-panel test out of pocket because of course we will. The results come back: no Alport syndrome. Great. But my wife’s kidneys are still irreversibly half damaged and struggling.

The nephrologist prescribes a powerful steroid to combat inflammation, along with two drugs to counteract side effects, plus another for blood pressure. The cocktail fills my wife with an iridescent power over the summer, which she enjoys. The part she does not enjoy is that the drugs make pregnancy a dangerous risk. She is 37. Just before her diagnosis, we had arrived at the decision to try for a family. I had my teaching job with Less-Shitty Insurance. We were ready. Now plans have changed. Which is fine—we will have wonderful years, with children or without. But kidney function directly correlates with life expectancy. Which is not fine. And the nephrologist said that this should have been caught earlier. The loss never should have been allowed to happen.

A WAR STORY: It is the Age of Extremely Shitty Insurance, and my wife has been on the phone with the insurance company for hours. I offer to take over so she can get ready for work, but they won’t allow it unless she submits some authorization form. I lose my calm. I yell bad words. Insurance hangs up. My wife cries, furious at me, the system, everything. She leaves for work. I stand in the quiet of the kitchen. Then I call back. I introduce myself as my wife. I speak in a Michael Jackson falsetto. I know my date of birth, my Social Security number, my address. Are they going to claim I’m not who I say I am? They are not.

For hours, as they transfer me around, we all pretend. I never break character. Which company was it? What was I fighting for? Did we win? I can’t remember. What I remember is holding the phone at arm’s length so I could laugh at the enraging absurdity of it all.

Molina Healthcare (MOH) Q2 2018 results, earnings-call transcript, excerpts, Joseph M. Zubretsky, president and CEO:

. . . Our marketplace business has continued to outperform our forecast . . .

It is becoming clear that the price increases we placed in the market along with improved . . .

. . . Across all product lines, we managed to a medical care ratio favorable . . .

Medical care ratio: a key metric that health insurance corporations use to calculate earnings. Under any name—benefits expense ratio (Anthem), health benefits ratio (Centene), medical benefits ratio (CVS Health)—the math is simple.

Total medical expenses paid by insurer / total premiums collected from members.

To put it simply: lower medical loss ratio, higher profits for the insurer.

More simply: From my perspective, the longer they can deposit your premiums while making it as difficult as possible for your family to get reimbursed for care, the more they make.

We think of these corporations as faceless behemoths riding the cold algorithms of market capitalism. They’re not. They’re captained by people who eat and sleep and shit like you and me. The Manhattan condominium where Josh Kushner was living in 2019? You can see photos online. What a place. There’s the kitchen where he poured his wine. The toilet where he scrolled his phone. I’m not saying that the people who run health insurance companies are evil. I don’t know them well enough. But I do know them better than they know my wife. None of them were—are—aware she exists. Yet each has impacted her—and our family, our future—in profound and irreversible ways.

I guess what I’m saying is this: They are the ones who made this personal.

Not me. Not my wife. Them.

MY WIFE ENJOYS a good summer followed by a not great fall. Numbers that should be low are rising. Numbers that should be high are falling. It’s October. Halloween. It’s autumn in America: pumpkin patches, open enrollment.

My wife and I stand before the computer, 20 tabs open. Open enrollment is our chance to select a new insurance plan from the eight that my school offers through two corporations. Each plan has different premiums, deductibles, networks. So much choice. So much freedom. It’s terrible.

Open enrollment exists—like much of Obamacare—to safeguard the insurance industry. Without open enrollment, the argument goes, healthy people would game the system by enrolling in insurance only when sick or injured.

But to view their argument differently, gaming the system would look a lot like accessing health care simply, without barriers, and when needed.

Instead, we are given a few weeks to predict what disease or accident might afflict our family in the calendar year ahead. Then we must balance this fortune-telling against our budget. My wife and I do the math for all situations. One situation involves kidney-disease remission. Other situations do not. One situation involves a baby. Most do not. My wife, ordered to avoid stress, must think hard on whether she will get to be a mother in this lifetime. She looks up kidney disease life-expectancy charts. She tells me I should get a new girlfriend if she dies early. She apologizes to me for being sick. We cry.

My school gave me two months to select a new plan. What seemed at first like an excessive amount of time isn’t nearly enough.

MORE THAN 29 million Americans carry medical debt.

One third of the money raised through GoFundMe is for medical costs.

There is something worse than Extremely Shitty Insurance. I am aware of this. Medical bankruptcy is worse. Not taking your child to the ER because you can’t afford to is worse. No insurance is worse.

I am aware that without Less-Shitty Insurance, a nephrologist may never have diagnosed my wife. Less-Shitty Insurance helped start her on a path to possible recovery.

That’s one way of viewing it.

Another way: Our insurance company at the time erected fewer hurdles between my wife and the care she needed.

Should I be grateful?

I’m asking in good faith. I’m honestly conflicted.

I FIND PURPOSE in protecting those I love. I ask them to wear helmets while biking. Seat belts, people. Do you know where the nearest fire extinguisher is? I do. I keep an earthquake kit beneath the bed. Every day in my classroom, I’m making a mental plan for a shooter—how to save as many of my students as possible. Captain Safety, my wife calls me. It must be a biological drive coded in our DNA—not unique to masculinity, but one way our genome compels me to be a good man. An impulse to protect.

So what happens to the spirit—the man—when confronted by a threat like the health insurance industry, so relentless and labyrinthian that even with all your waking hours, even with your best falsetto, you cannot help those you most love? What to do with the anger? The frustration? The hopelessness? What to feed it to keep it from feeding on you?

MORE THAN A YEAR has passed since my wife’s diagnosis. She continues to see the nephrologist, and sometimes an acupuncturist and an herbalist. Our Less-Shitty Health Insurance says it covers acupuncture, but it rejects my wife’s claim (reason: “a smudged stamp” on the form) and it’s less stressful to pay out of pocket than to appeal. There’s no point in filing a claim for the herbalist. Her numbers go up, her numbers go down. Good weeks are followed by terrible weeks. One terrible week in early 2022, she faints at the lab while having blood drawn. I half carry her across the street to the ER. After a long night, we return home, exhausted, to find a $900 medical bill in the mailbox, dated, inexplicably, nine months earlier, and claiming that—

NO. I AM so sick of this. I can’t. I just can’t.

I hate talking about insurance. Why can’t I stop talking about insurance?

Because I must process what’s happening to the woman I love.

But there is another reason, I think—another reason we are compelled to tell stories. We are a social species. Our success stems almost exclusively from cooperation. We are not built to defeat huge existential threats alone. We tell stories not just for catharsis but for strategy. To share knowledge. To plan. What worked? What didn’t? What might we do—if not in our lifetime, then for our nieces, our nephews, the fragile, gorgeous world to come—to eliminate the threat for good?

We hate talking about it. We have to talk about it.

We can’t stop. We shouldn’t.

This story originally appeared in the September 2022 issue of Men's Health.

Nick Fuller Googins is a fourth-grade teacher and the author of the upcoming novel, The Great Transition. His writing has appeared in The Los Angeles Times, The Paris Review, The Sun, and elsewhere.